Income Statement vs P&L: Understanding the Key Differences

Is a P&L the same as an Income Statement

Wondering about the difference between an Income Statement vs P&L? The short answer is that they're generally the same, both referring to a financial report that shows your business's financial performance over a specific period. It’s all in the terminology. However, to understand why the confusion exists, and the slight nuances, let's dive deeper. You're not alone! Many small business owners, especially those diving into the world of QuickBooks and DIY bookkeeping, often get tripped up by these terms. It might seem like accounting has its own secret language sometimes, but don't worry, we're here to translate it into plain English.

Think of it like this: you're running a fantastic little food truck. You know how much money you make selling tacos and how much you spend on ingredients, wages, and that awesome salsa recipe. Well, an Income Statement or a P&L is simply a way to organize all that information on paper, or computer screen, to see if your food truck is actually making a profit. It's like a financial snapshot of your business over a specific period, showing whether you're in the black (profitable) or in the red (in the hole - aka bleeding money).

In this post, we'll take a friendly stroll through the world of financial statements and clear up any confusion about the Income Statement vs P&L. We'll explore what each one is, how they're similar, and where they might differ. By the end, you'll feel much more confident in understanding these essential tools for your business's financial health. Plus, we'll throw in some real-world examples to make it even easier to grasp. So, let's get started and turn you into an Income Statement and P&L pro!

What is an Income Statement?

So, what exactly is an Income Statement? In the simplest terms, it's a financial report that shows your business's financial performance over a specific period. Think of it as a video of your business's money flow, while a balance sheet is more like a snapshot at a single point in time. Whether you run a bustling bakery, a thriving online store, or a local dry cleaning service, an Income Statement helps you understand whether you're making a profit or taking a loss.

To break it down further, an Income Statement follows a basic formula:

Revenue - Expenses = Net Income (or Net Loss)

Revenue: This is the total amount of money your business earns from selling goods or services. For our taco truck, revenue would be all the money collected from those delicious tacos, burritos, and drinks.

Expenses: These are all the costs your business incurs to generate that revenue. For the taco truck, expenses would include ingredients, wages for employees, fuel for the truck, permits, and even the cost of those paper wrappers.

Net Income (or Net Loss): This is the "bottom line." If your revenue is greater than your expenses, you have a Net Profit (positive Net Income). Or if your expenses are greater than your revenue, you have a Net Loss (negative Net Income).

An Income Statement typically covers a specific period, such as a month, a quarter, or a year. It's crucial for tracking your business's progress, making informed decisions, and even filing your taxes. By regularly reviewing your Income Statement, you can identify trends, control costs, and ensure your business stays on the path to success.

Income Statement = Profit and Loss (P&L) Statement

What is a Profit and Loss (P&L) Statement?

Now, let's turn our attention to the P&L statement. If you're thinking, "Wait, isn't that the same thing as an Income Statement?". Well, you're on the right track! A P&L statement, also known as a Profit and Loss statement, is essentially another name for an Income Statement. It's also a financial report that summarizes a company's revenues, costs, and expenses during a specific period of time. In fact, many small businesses in areas like Cumming, Georgia, use the terms interchangeably. So, if you're a business owner in Metro Atlanta, don't be surprised to hear accountants refer to your Income Statement as a P&L. If you are in Mission Valley, a suburb of San Diego, California, your CPA might call it an Income Statement, while your restaurant manager or owner-operator calls it a P&L.

Just like an Income Statement, the P&L statement helps business owners understand their profitability. It follows the same basic formula:

Revenue - Expenses = Net Profit (or Net Loss)

You'll notice that the formula is the same, but the terminology is slightly different. While an Income Statement uses "Net Income," a P&L statement uses "Net Profit." However, both terms refer to the same thing: the amount of money a business has left over after paying all its expenses. If the result is negative, it's called a "Net Loss" on both statements. Understanding this difference between net income and net profit is crucial for accurate financial reporting.

To illustrate, imagine you own a small boutique jewelry store that sells custom jewelry. Additionally, you sell your products online and at craft fairs, trade shows, and private events. Your P&L statement would show all your sales revenue from necklaces, earrings, and bracelets, as well as all your expenses, such as the cost of materials, website hosting fees, marketing costs, transportation expenses, shipping fees, etc. You would want to track revenue from sales at local craft fairs, trade shows, online, and private events, while also accounting for expenses like booth fees and shipping costs, etc. to customers across the US. By subtracting your total expenses from your total revenue, you can quickly determine whether your boutique jewelry business is profitable.

The P&L statement is an invaluable tool for small business owners because it provides a clear picture of their financial performance. It can help them track their progress over time, identify areas where they can cut costs (something especially important for businesses in competitive markets like Metro Atlanta and San Diego), and make informed decisions about pricing, marketing, and inventory management.

Income Statement vs. P&L: The Similarities

Now that we've defined both the Income Statement and the P&L statement, it's time to highlight their similarities. Understanding what these two reports have in common will further clarify why they're often used interchangeably. Essentially, both the Income Statement and the P&L statement serve the same fundamental purpose: to provide a clear and concise summary of a business's financial performance over a specific period. Whether you're analyzing a report for a tech startup in San Diego or a manufacturing company in Dalton, GA, the core information conveyed remains consistent.

The primary similarity between an Income Statement and a P&L statement lies in the data they present. Both reports utilize the same basic financial information: revenue and expenses. Revenue represents the total income generated from the sale of goods or services, while expenses encompass all the costs incurred to earn that revenue. This includes everything from the cost of goods sold (COGS) and operating expenses to interest and taxes. The way this information is organized and presented may vary slightly, but the underlying figures remain the same.

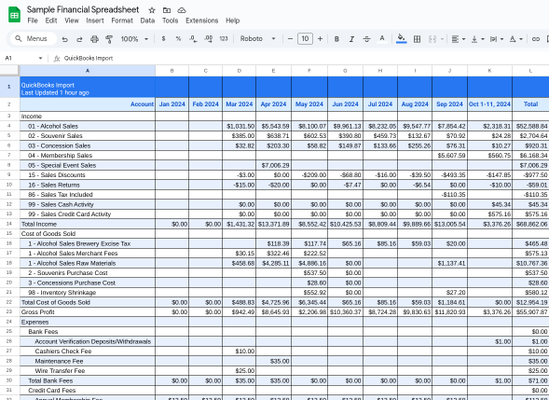

Ultimately, both the Income Statement and the P&L statement arrive at the same "bottom line" figure: net income or net profit. This figure represents the business's profitability over the reporting period, indicating whether it generated more revenue than it spent in expenses. Whether you call it "Net Income" or "Net Profit," it's the key metric that business owners, investors, and lenders use to assess a company's financial health and performance. So, if you're looking at a financial report for a local boutique in Metro Atlanta and see a "Net Profit" of $50,000, that's the same as saying the business had a "Net Income" of $50,000. In our sample Income Statement of ABC Microbrewery, we can see that our “Total Income” was $68,862.06 (cell: L:14), but our “Total Expenses” was $95,146.97 (cell: L:142). And our bottom line, “Net Income” was -$50,795.37 (cell: L:156) We will dive deeper into the other details of this sample Income Statement later.

Income Statement vs. P&L: The Differences

While we've established that the Income Statement and P&L statements are largely the same, there are some subtle differences that contribute to the confusion. Understanding these nuances can help you navigate financial reports with greater confidence, whether you're dealing with a local business in San Diego or a regional company in Metro Atlanta.

One of the primary differences lies in terminology and usage, which often varies by region and industry. In the United States, particularly in formal accounting contexts, the term "Income Statement" is more commonly used. This is especially true when referring to reports prepared according to Generally Accepted Accounting Principles (GAAP). However, in other parts of the world, such as the United Kingdom and Australia, the term "Profit and Loss statement" or "P&L" is more prevalent. So, a business owner in Forsyth County might be more accustomed to hearing "P&L," while their Peachtree City accountant might use "Income Statement" in official documents.

Another potential difference, although less common, is the level of detail presented in the report. Some companies might prepare a more summarized P&L for internal use, providing a quick overview of revenue and expenses. In contrast, an Income Statement prepared for external stakeholders, such as investors or lenders, might be more detailed, breaking down revenue and expenses into specific categories. For instance, a restaurant in Mission Valley might have a simple P&L for daily tracking but a more detailed Income Statement for quarterly reporting to investors.

It's important to note that these differences are not rigid rules. Many businesses and, less frequently, accountants use the terms Income Statement and P&L interchangeably, regardless of location or report purpose. The key takeaway is that both reports ultimately convey the same essential information about a company's financial performance. Understanding this will help you avoid confusion and focus on the important insights the reports provide.

So, Are They the Same? Is the Income Statement the Same as P&L? (Yes)

So, let's get to the heart of the matter: Are an Income Statement and a P&L statement the same? The most straightforward answer is: Yes. In most cases, the terms are used interchangeably to describe the same financial report. Whether you're a small business owner in Southern California or a growing company in Hotlanta, you'll likely encounter both terms, and it's important to understand that they're typically referring to the same thing.

However, as we discussed in the previous section, there can be subtle nuances in terminology and level of detail. While the core purpose and content of both reports remain consistent, the specific name used might vary based on regional preferences, industry conventions, or the intended audience of the report. For instance, a construction company in Duluth, Georgia might primarily use the term "P&L" for its internal reports, while its external financial statements might be labeled "Income Statement" to adhere to formal accounting standards.

Ultimately, the key takeaway is that both an Income Statement and a P&L statement provide a summary of a company's financial performance over a specific period. They both follow the same basic formula (Revenue - Expenses = Net Income/Net Profit) and present the same essential information about a company's profitability. Therefore, while it's helpful to be aware of the potential variations in terminology and detail, it's more important to focus on understanding the underlying financial data and insights that these reports provide.

Interested in learning more? Join Our Community to stay in the loop or Schedule an Appointment to learn more about how Sync-Up Bookkeeping can help you grow your small business.

Share on Social

Bookkeeping in Action:

The Adventures of Coco and Cami

Follow the entrepreneurial journeys of Coco, who's opening a sandwich shop, and Cami, starting a coffee shop, as they find themselves faced with the new challenges of bookkeeping to track their businesses.

Watch as Professor A breaks down the fundamental concepts of bookkeeping for Coco and Cami, explaining why it's the essential foundation for understanding a business's financial health.