Indirect Expenses

Indirect Expenses

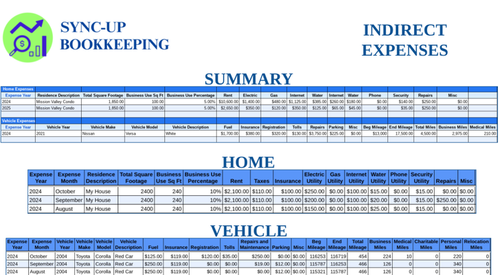

| ✪ Indirect Expense Summary (Sample) |

|---|

|

The Indirect Expense Summary report provides a consolidated view of a company's indirect expenses, which are costs associated with the business use of personal property. These expenses are not typically tracked directly within standard accounting software but are essential for accurate financial reporting and tax purposes. The report summarizes expenses related to:

By analyzing the Indirect Expense Summary report, businesses can ensure they are accurately capturing and deducting these expenses, maximizing tax benefits and maintaining compliance with IRS regulations. |

Indirect Expense Summary:

Key Concepts & Connections

Concepts Related to the

Indirect Expense Summary

The Indirect Expense Summary is a specialized report for tracking the Business Use of Personal Property. This includes common but often missed Tax Deductions like the Home Office Expense and vehicle mileage. Meticulous Expense Tracking of these costs is required to legally Write Off a portion of personal expenses for business use, a key strategy for reducing your taxable income.

Indirect Expenses

in Action:

The Adventures of Coco and Cami

Cami uses her personal cell phone and car for her coffee business, but she has no idea how to separate the business use from personal use for tax purposes. She's worried she's missing out on deductions but is also afraid of getting it wrong with the IRS.

Professor A introduces her to the Indirect Expense Summary report generated by the SecureDocs portal. He shows her how tracking her business mileage and estimating the business use percentage of her phone bill allows Sync-Up to create a clear, compliant report. This report gives her the exact numbers her CPA needs to claim these deductions confidently.

Take the Next Step

Are you maximizing your deductions for the business use of your home and vehicle? Our Indirect Expense Summary report helps you find and track these "hidden" tax savings. To ensure you're not leaving money on the table, schedule a free 30-minute consultation today.

Contact Sales for a Free Consultation