Bookkeeping for

Web Developers

As a web developer, you build the digital infrastructure of modern business, writing clean code and creating seamless user experiences. But while you're architecting the front-end and back-end for your clients, the financial backend of your own business can often become neglected. The primary challenge is tracking profitability across different revenue models. It’s difficult to compare the profit from a large, one-time website build against the long-term value of your monthly maintenance and hosting retainers. You're likely juggling dozens of recurring software subscriptions—for hosting, domains, premium plugins, and project management tools—and these "SaaS sprawl" expenses can quietly eat away at your margins. Without a clear system, it's hard to price your services accurately and plan for your own quarterly tax obligations as a freelance professional.

Solutions by Sync-Up

At Sync-Up Bookkeeping, we help you debug your finances. We are your dedicated financial partners, specializing in the project- and retainer-based models of technical freelancers. We implement systems that track profitability by project and by client, giving you the data to build more profitable proposals and retainers. Our meticulous expense tracking organizes every software and hosting subscription, ensuring you capture every tax-deductible cost. We streamline your invoicing and provide clear cash flow insights, so you always know where your business stands financially. While we don’t file your taxes, we are an essential partner for your CPA. We deliver perfectly organized financial records that make tax compliance a simple deployment, not a stressful launch. Let us handle the financial framework so you can focus on building amazing things on the web.

Ready to build a stronger financial foundation? Schedule a free consultation or explore our transparent pricing to learn more.

Take the Next Step

Ready to gain financial clarity and focus on what you do best. Let’s schedule a free 30-minute no-obligation consultation. We're eager to understand your specific needs and become your trusted business partner.

Contact Sales for a Free ConsultationKeep in Touch

Join Our CommunityShare on Social

The Developer's Challenge: Debugging Your Own Finances

You build beautiful, functional websites, but the backend of your own business can have some bugs. It's difficult to track the profitability of a large website build after accounting for the cost of premium plugins, themes, and your own countless hours. Juggling one-off projects with ongoing monthly maintenance retainers creates a confusing income stream. Most importantly, are you tracking all your recurring software and hosting subscriptions as deductible business expenses? Forgetting to do so means paying more in taxes than necessary.

A Clean Codebase for Your Bookkeeping

Sync-Up Bookkeeping helps you debug your finances. We implement project-based costing to see your exact profit margin on every website you build, helping you create more profitable proposals in the future. We streamline the tracking of your recurring retainer revenue and ensure every single software, hosting, and plugin subscription is properly categorized for maximum tax deductions. We make sure you're always ready for quarterly tax payments so you can focus on shipping projects, not crunching numbers.

Focus on Building, Not on Billing

Imagine focusing all your mental energy on solving complex coding problems instead of worrying about invoices and expenses. With organized books, you can price your projects and retainers with confidence, knowing you're building a financially secure business. You’ll have a clear view of your cash flow, allowing you to invest in better tools and training. We handle the business administration so you can get back to doing what you love: building amazing things for the web.

Take the Next Step

Ready to gain financial clarity and focus on what you do best. Let’s schedule a free 30-minute no-obligation consultation. We're eager to understand your specific needs and become your trusted business partner.

Contact Sales for a Free ConsultationKeep in Touch

Join Our CommunityShare on Social

Bookkeeping in Action: The Adventures of Coco and Cami

Follow the entrepreneurial journeys of Coco, who's opening a sandwich shop, and Cami, starting a coffee shop, as they find themselves faced with the new challenges of bookkeeping to track their businesses.

Watch as Professor A breaks down the fundamental concepts of bookkeeping for Coco and Cami, explaining why it's the essential foundation for understanding a business's financial health.

Sync-Up Bookkeeping is perfect for:

Who We Help

Small business owners who need financial clarity

Startups looking to manage expenses and plan growth

Professionals in food service, healthcare, tech, construction, and more industries.

Entrepreneurs who want to focus on running their business

Why Choose Sync-Up Bookkeeping?

We’re not just bookkeepers—we’re your dedicated financial advocates. Our team works alongside you to provide real-time financial insights, helping you make informed decisions and avoid costly mistakes.

✔ 98% Client Satisfaction Rate – Our clients trust us to provide expert guidance and support.

✔ Save 40+ Hours Per Month - More time to focus on growing your business.

✔ $10,000+ in Missed Deductions Found - We ensure you keep more of your hard-earned money.

✔ Financial Clarity & Peace of Mind – Get the confidence to make strategic decisions with accurate, up-to-date financial reports.

Simplify Your Finances & Grow Your Business with Services that Matter

We help business owners reclaim time, improve financial clarity, and maximize profitability with expert bookkeeping services. Whether you need ongoing support, catch-up bookkeeping, or financial guidance, Sync-Up Bookkeeping is here for you.

General Bookkeeping

Catch-Up Bookkeeping

Cash Flow Monitoring

Audit Protection

Asset Tracking

Expense Tracking

Expansion Planning

Payroll

Wealth Protection

Understand your Financial Position

Reports that are Relevant and Actionable

Tailored reports deliver personalized financial understanding, going beyond the basics. From detailed expense breakdowns and performance analyses to high-level snapshots and executive summaries, complex data is transformed into actionable insights, tailored to unique business needs.

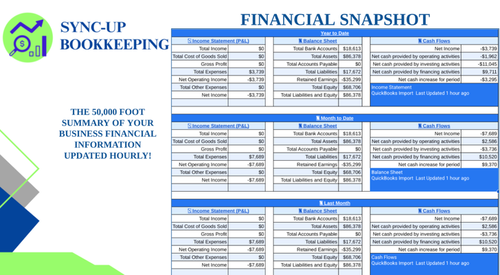

Snapshot Reports

The Snapshot report provides a high-level, 50,000-foot overview of a company's financial performance, summarizing key data from the three main financial statements: the Income Statement, Balance Sheet, and Statement of Cash Flows.

Performance Reports

The Performance Ratios report provides a comprehensive overview of a company's financial health and performance, using key performance indicators (KPIs) and ratios derived from the three main financial statements.

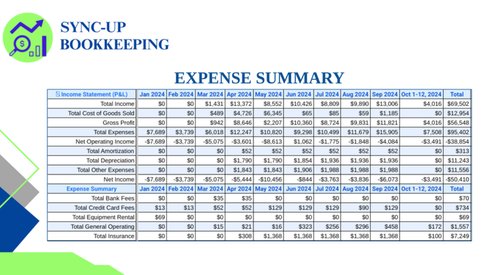

Summary Reports

This 30,000-foot view allows businesses to track their spending patterns in greater detail and identify trends and anomalies over time.

Meet Your Dedicated Financial Advocates

We’re not just bookkeepers—we’re partners in your success. Our team works alongside you to provide real-time financial insights, helping you make informed decisions and avoid costly mistakes.

Andrew Clarke, CEO

From startups to Fortune 500s, Andrew's 45+ years of diverse experience across industries like aerospace, healthcare, and finance, uniquely equip him to simplify your business's bookkeeping and financial reporting. Andrew is passionate about making bookkeeping simple and stress-free. A nature-loving, fun, and business-savvy leader, Andrew ensures Sync-Up Bookkeeping is a trusted partner in financial success.

Sheri Clarke, COO

Sheri Clarke serves as COO of Sync-Up Bookkeeping, bringing over 30 years of experience in business operations and management to the role. Having a well-rounded perspective on the challenges businesses face, her experience uniquely positions her to help clients streamline processes and achieve success.

Ron Nocera, CMO

Ron Nocera serves as Sync-Up’s Chief Marketing Officer. Ron brings a strong background in process improvement and sales optimization to Sync-Up Bookkeeping. With a proven track record of driving efficiency and leading global teams, Ron is focused on developing and executing effective marketing strategies that support business growth.

Learn about the Sync-Up Difference:

Bookkeeping That Fuels Your Business Growth

Struggling to keep up with your business finances? You're not alone!

Sync-Up Bookkeeping is more than just a bookkeeping service. We're your partners in financial success, providing expert guidance and support to help your business thrive. Watch this video to learn how we go beyond the numbers to help you achieve your goals.

Real Results from Real Clients

See how our Small Business Bookkeeping Services have helped businesses just like yours streamline their finances and achieve growth.

-

"As a mortgage broker, accurate and insightful bookkeeping is essential to my business. Andrew Clarke at Sync-Up Bookkeeping has been absolutely invaluable in that regard. His expertise goes beyond just keeping my books in order; he provides truly insightful advice that has helped me make better business decisions. Andrew's knowledge of accounting and finance is exceptional, and I trust his judgment completely. I've known Andrew for over 5 years and his integrity and trustworthiness are unmatched. I've referred friends, family, and business associates to Sync-Up Bookkeeping, and they've all been incredibly impressed with his services. If you're looking for a top-notch bookkeeper who truly understands business, I highly recommend Andrew Clarke!"

Cody Daniel, Mortgage Banker

-

"Andrew Clarke is an extremely knowledgeable and professional bookkeeper who is a pleasure to work with. He has a vast knowledge of business, accounting, and finance, and he is always willing to go the extra mile to help his clients. He is also very personable and easy to talk to, and he always makes me feel like I am his top priority. I would highly recommend Andrew Clarke and Sync-Up Bookkeeping to anyone who is looking for a top-notch bookkeeper. He is an invaluable asset to my business, and I would not be able to do what I do without him."

Dr. Jacqueline Grant, DC, 100% Chiropractic

-

"One of the best moves made for my business. The staff and tools provided at Sync-Up make my bookkeeping effortless. They are very knowledgeable and help educate my office staff on good accounting practices."

Robert Cheek, Heavale Brewing

-

"I can't recommend Andrew and Sync-Up Bookkeeping enough! As a pool maintenance business owner, I used to dread dealing with my finances. But Andrew has been an absolute lifesaver. Over the past 4 years, he's not only helped me set up my QuickBooks accounts flawlessly, but he's also taken the time to teach me the ins and outs of good bookkeeping practices. He's incredibly patient, knowledgeable, a teacher by nature, and is always willing to answer my questions (no matter how small!). What truly sets Andrew apart is his honesty, integrity, and genuine interest in seeing my business succeed. He's become a trusted advisor, offering valuable insights that go beyond just bookkeeping. Thanks to Sync-Up, I now have a clear understanding of my financials, which has allowed me to make better business decisions and ultimately increase my profits. If you're looking for a bookkeeper who is more than just a number cruncher, someone who truly cares about your business, then look no further than SyncUp Bookkeeping. You won't be disappointed!"

Monica Bayon, Bayon Pool Service

Insights & Expert Advice – Read Our Blog

Stay ahead of the curve with expert bookkeeping tips, financial strategies, and business growth insights. Our blog covers everything from tax-saving tips to financial planning best practices.

Managing business finances goes beyond tracking profits—it’s also about maintaining healthy cash flow and preventing payment issues before they escalate. One of the most effective ways to avoid financial headaches is by maintaining accurate and organized bookkeeping records. When your financial data is clear, you can make better business decisions, reduce the risk of unpaid debts, and minimize the need for legal intervention.

In this guide, we’ll explore why proper bookkeeping matters, how it impacts cash flow and collections, and practical steps to keep your accounts in order.

Stop guessing with your numbers. Our guide to cleaning service bookkeeping helps Gwinnett County business owners understand their finances.

Originally published as an eBook, this comprehensive guide is your roadmap to financial health. It delves into the essential principles and practical strategies for managing revenue, controlling expenses, navigating tax compliance, and planning for sustainable growth. Move beyond financial frustration and start building a stronger foundation for your business today.

Your Financial Clarity Starts Today

Ready to take control of your finances and grow your business with confidence? Sync-Up Bookkeeping offers expert bookkeeping services, providing virtual support and financial insights tailored to your industry.

Book a Free 30-Minute Consultation and see how we can support your success.