Bookkeeping for

Body Waxing Studios

Your waxing studio provides clients with a smooth, confident feeling through professional and meticulous service. But achieving that same smooth, confident feeling in your business finances can be a sticky situation. The primary financial challenge is understanding the true cost of every service you provide. Accurately tracking your consumable costs—from the specific wax and strips used for a leg wax versus a brow shaping—is essential for profitable pricing. When you add in the management of retail products like after-care lotions and the complexity of calculating commission-based payroll for your team of estheticians, the financial picture can become unclear. It's tough to know which services are truly your most profitable without a system designed for these details.

Solutions by Sync-Up

At Sync-Up Bookkeeping, we get into the details of your waxing business so you don't have to. We are your dedicated financial partners, committed to giving you the clarity to grow your studio with confidence. We help you implement detailed service costing, tracking your supply usage against service revenue so you can see your true profit margins. Our system simplifies inventory management for both your professional and retail products. We streamline your payroll, easily handling commissions for both services and retail product sales. While we do not prepare taxes, we deliver perfectly organized, CPA-ready financial records. We ensure every supply purchase and sale is correctly categorized, making tax compliance a smooth and painless process. Let us handle the sticky financial situations so you can focus on providing the flawless service your clients love.

Ready to build a stronger financial foundation? Schedule a free consultation or explore our transparent pricing to learn more.

Take the Next Step

Ready to gain financial clarity and focus on what you do best. Let’s schedule a free 30-minute no-obligation consultation. We're eager to understand your specific needs and become your trusted business partner.

Contact Sales for a Free ConsultationKeep in Touch

Join Our CommunityShare on Social

The Waxing Studio Challenge: A Sticky Financial Situation

You provide a smooth, professional experience for your clients, but your business finances are anything but. Tracking the cost of consumable supplies—different types of wax, strips, cleansers, and lotions—for each specific service is a major challenge. Are you making more on a 15-minute brow wax or a 45-minute leg wax after accounting for both your time and the cost of materials? Managing payroll and commissions for your team of estheticians adds another layer of complexity, making it hard to price your services for maximum profitability.

A Smooth Process for Your Books

Sync-Up Bookkeeping gets into the important details of your waxing business. We help you implement a system to track your supply costs per service, revealing your true profit margins. We streamline payroll, easily handling commissions for both services rendered and any retail products sold. Our clear monthly reports give you the data you need to manage your inventory, optimize your service menu for profitability, and confidently grow your studio.

Focus on Your Clients, Not Your Costs

Price every service on your menu with confidence, knowing it's built on accurate data. Free up your time to focus on what you love—providing exceptional service and making your clients feel their best. You'll gain the financial clarity to invest in top-of-the-line products, advanced training for your team, or expanding your studio space. Let us handle the sticky financial details so you can concentrate on building a smooth-running, successful business.

Take the Next Step

Ready to gain financial clarity and focus on what you do best. Let’s schedule a free 30-minute no-obligation consultation. We're eager to understand your specific needs and become your trusted business partner.

Contact Sales for a Free ConsultationKeep in Touch

Join Our CommunityShare on Social

Bookkeeping in Action: The Adventures of Coco and Cami

Follow the entrepreneurial journeys of Coco, who's opening a sandwich shop, and Cami, starting a coffee shop, as they find themselves faced with the new challenges of bookkeeping to track their businesses.

Watch as Professor A breaks down the fundamental concepts of bookkeeping for Coco and Cami, explaining why it's the essential foundation for understanding a business's financial health.

Sync-Up Bookkeeping is perfect for:

Who We Help

Small business owners who need financial clarity

Startups looking to manage expenses and plan growth

Professionals in food service, healthcare, tech, construction, and more industries.

Entrepreneurs who want to focus on running their business

Why Choose Sync-Up Bookkeeping?

We’re not just bookkeepers—we’re your dedicated financial advocates. Our team works alongside you to provide real-time financial insights, helping you make informed decisions and avoid costly mistakes.

✔ 98% Client Satisfaction Rate – Our clients trust us to provide expert guidance and support.

✔ Save 40+ Hours Per Month - More time to focus on growing your business.

✔ $10,000+ in Missed Deductions Found - We ensure you keep more of your hard-earned money.

✔ Financial Clarity & Peace of Mind – Get the confidence to make strategic decisions with accurate, up-to-date financial reports.

Simplify Your Finances & Grow Your Business with Services that Matter

We help business owners reclaim time, improve financial clarity, and maximize profitability with expert bookkeeping services. Whether you need ongoing support, catch-up bookkeeping, or financial guidance, Sync-Up Bookkeeping is here for you.

General Bookkeeping

Catch-Up Bookkeeping

Cash Flow Monitoring

Audit Protection

Asset Tracking

Expense Tracking

Expansion Planning

Payroll

Wealth Protection

Understand your Financial Position

Reports that are Relevant and Actionable

Tailored reports deliver personalized financial understanding, going beyond the basics. From detailed expense breakdowns and performance analyses to high-level snapshots and executive summaries, complex data is transformed into actionable insights, tailored to unique business needs.

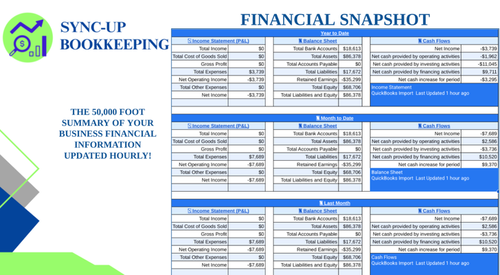

Snapshot Reports

The Snapshot report provides a high-level, 50,000-foot overview of a company's financial performance, summarizing key data from the three main financial statements: the Income Statement, Balance Sheet, and Statement of Cash Flows.

Performance Reports

The Performance Ratios report provides a comprehensive overview of a company's financial health and performance, using key performance indicators (KPIs) and ratios derived from the three main financial statements.

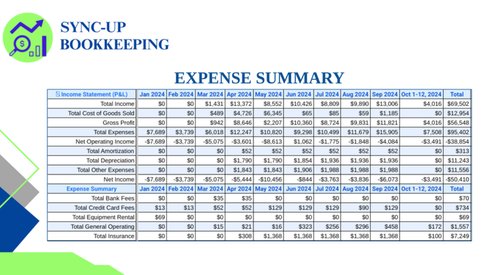

Summary Reports

This 30,000-foot view allows businesses to track their spending patterns in greater detail and identify trends and anomalies over time.

Meet Your Dedicated Financial Advocates

We’re not just bookkeepers—we’re partners in your success. Our team works alongside you to provide real-time financial insights, helping you make informed decisions and avoid costly mistakes.

Andrew Clarke, CEO

From startups to Fortune 500s, Andrew's 45+ years of diverse experience across industries like aerospace, healthcare, and finance, uniquely equip him to simplify your business's bookkeeping and financial reporting. Andrew is passionate about making bookkeeping simple and stress-free. A nature-loving, fun, and business-savvy leader, Andrew ensures Sync-Up Bookkeeping is a trusted partner in financial success.

Sheri Clarke, COO

Sheri Clarke serves as COO of Sync-Up Bookkeeping, bringing over 30 years of experience in business operations and management to the role. Having a well-rounded perspective on the challenges businesses face, her experience uniquely positions her to help clients streamline processes and achieve success.

Ron Nocera, CMO

Ron Nocera serves as Sync-Up’s Chief Marketing Officer. Ron brings a strong background in process improvement and sales optimization to Sync-Up Bookkeeping. With a proven track record of driving efficiency and leading global teams, Ron is focused on developing and executing effective marketing strategies that support business growth.

Learn about the Sync-Up Difference:

Bookkeeping That Fuels Your Business Growth

Struggling to keep up with your business finances? You're not alone!

Sync-Up Bookkeeping is more than just a bookkeeping service. We're your partners in financial success, providing expert guidance and support to help your business thrive. Watch this video to learn how we go beyond the numbers to help you achieve your goals.

Real Results from Real Clients

See how our Small Business Bookkeeping Services have helped businesses just like yours streamline their finances and achieve growth.

-

"As a mortgage broker, accurate and insightful bookkeeping is essential to my business. Andrew Clarke at Sync-Up Bookkeeping has been absolutely invaluable in that regard. His expertise goes beyond just keeping my books in order; he provides truly insightful advice that has helped me make better business decisions. Andrew's knowledge of accounting and finance is exceptional, and I trust his judgment completely. I've known Andrew for over 5 years and his integrity and trustworthiness are unmatched. I've referred friends, family, and business associates to Sync-Up Bookkeeping, and they've all been incredibly impressed with his services. If you're looking for a top-notch bookkeeper who truly understands business, I highly recommend Andrew Clarke!"

Cody Daniel, Mortgage Banker

-

"Andrew Clarke is an extremely knowledgeable and professional bookkeeper who is a pleasure to work with. He has a vast knowledge of business, accounting, and finance, and he is always willing to go the extra mile to help his clients. He is also very personable and easy to talk to, and he always makes me feel like I am his top priority. I would highly recommend Andrew Clarke and Sync-Up Bookkeeping to anyone who is looking for a top-notch bookkeeper. He is an invaluable asset to my business, and I would not be able to do what I do without him."

Dr. Jacqueline Grant, DC, 100% Chiropractic

-

"One of the best moves made for my business. The staff and tools provided at Sync-Up make my bookkeeping effortless. They are very knowledgeable and help educate my office staff on good accounting practices."

Robert Cheek, Heavale Brewing

-

"I can't recommend Andrew and Sync-Up Bookkeeping enough! As a pool maintenance business owner, I used to dread dealing with my finances. But Andrew has been an absolute lifesaver. Over the past 4 years, he's not only helped me set up my QuickBooks accounts flawlessly, but he's also taken the time to teach me the ins and outs of good bookkeeping practices. He's incredibly patient, knowledgeable, a teacher by nature, and is always willing to answer my questions (no matter how small!). What truly sets Andrew apart is his honesty, integrity, and genuine interest in seeing my business succeed. He's become a trusted advisor, offering valuable insights that go beyond just bookkeeping. Thanks to Sync-Up, I now have a clear understanding of my financials, which has allowed me to make better business decisions and ultimately increase my profits. If you're looking for a bookkeeper who is more than just a number cruncher, someone who truly cares about your business, then look no further than SyncUp Bookkeeping. You won't be disappointed!"

Monica Bayon, Bayon Pool Service

Insights & Expert Advice – Read Our Blog

Stay ahead of the curve with expert bookkeeping tips, financial strategies, and business growth insights. Our blog covers everything from tax-saving tips to financial planning best practices.

Managing business finances goes beyond tracking profits—it’s also about maintaining healthy cash flow and preventing payment issues before they escalate. One of the most effective ways to avoid financial headaches is by maintaining accurate and organized bookkeeping records. When your financial data is clear, you can make better business decisions, reduce the risk of unpaid debts, and minimize the need for legal intervention.

In this guide, we’ll explore why proper bookkeeping matters, how it impacts cash flow and collections, and practical steps to keep your accounts in order.

Stop guessing with your numbers. Our guide to cleaning service bookkeeping helps Gwinnett County business owners understand their finances.

Originally published as an eBook, this comprehensive guide is your roadmap to financial health. It delves into the essential principles and practical strategies for managing revenue, controlling expenses, navigating tax compliance, and planning for sustainable growth. Move beyond financial frustration and start building a stronger foundation for your business today.

Your Financial Clarity Starts Today

Ready to take control of your finances and grow your business with confidence? Sync-Up Bookkeeping offers expert bookkeeping services, providing virtual support and financial insights tailored to your industry.

Book a Free 30-Minute Consultation and see how we can support your success.